Only 1 in 4 Indian households surveyed see their earnings and savings rising in 2025

- ● 48% households surveyed expect up to 25% dip in earnings in 2025 while 45% expect up to 25% dip in savings this calendar year

- ● Budget 2025 must seriously consider interventions that help the middle-class households sustain

January 7, 2025, New Delhi: Lack of income growth in most households along with consistently high food inflation led to Indians reducing discretionary spending in 2024 with retailers reporting below expectations growth in sales of electronics, home appliances and personal vehicles.

As more income is allocated to debt repayment, overall consumption continues to be impacted. Rising household debt, driven by increased retail borrowing such as personal loans and credit card usage, also restricted consumer spending, according to an EY report.

Household borrowings rose to 5.8% of GDP, marking the highest levels since the 1970s. To maintain their standard of living amid increasing expenses, many families dipped into their savings, leading to concerns about long-term financial security. As a result, household savings in India have dropped to a multi-decadal low with net financial savings standing at around 5.3% of GDP in FY 23.

Indian households expect inflation to rise further while consumer confidence took a knock due to weaker sentiments, according to RBI’s forward-looking surveys in November. The latest round of RBI survey of households’ inflation expectations was conducted during November 2-11, 2024. The survey showed that a somewhat larger share of respondents expects the year-ahead price and inflation to increase in November survey compared to September 2024 round. Households’ median perception of current inflation rose by 30 basis points (bps) to 8.4%, as compared 8.1% of the previous survey round in September 2024.

Median inflation expectation for the three months horizon moderated marginally by 10 bps to 9.1%, whereas it inched up by 10 bps to 10.1% for one year period ahead, RBI said in a statement. The increase was mainly due to higher pressures from food items and housing-related expenses. In December, per Crisil data, the price of a vegetarian thali (a meal) went up by 6% and by 12% for a non-vegetarian thali. It must be noted that it is the middle-class households that have been feeling the pinch the most as they are not the beneficiaries of PMGKAY or any other program which covers 82 crore citizens currently.

With over a thousand posts and comments since July 2024 on the subject of rising inflation, declining earnings growth and declining savings received from household consumers and Budget 2025 round the corner, LocalCircles conducted a national household earnings and savings outlook survey to understand their projections for 2025. The survey received over 32,000 responses from household consumers located in 334 districts of India. 67% respondents were men while 33% respondents were women. 40% respondents were from tier 1, 27% from tier 2 and 33% respondents were from tier 3 and 4 districts.

Only 24% Indian households surveyed are confident that their annual income will increase in 2025

The survey first asked household consumers, “Where do you believe your household income will be in the next 12 months (Jan-Dec 25) in comparison to previous 12 months (Jan-Dec 24)?” Out of 16,111 who responded to the question 24% stated “will reduce by 25% or more”; 12% stated “will reduce by 10-25%”; 4% stated "will by 0-10%”; 8% stated "will reduce – can’t say how much right now”; 28% of respondents stated that they expect “no impact”; 16% stated they expect it “will increase by 0-25%”; and 8% stated “will increase – can’t say how much”. To sum up, only 24% Indian households surveyed are confident that their annual income will increase in 2025; 48% of households surveyed expect up to 25% dip in earnings.

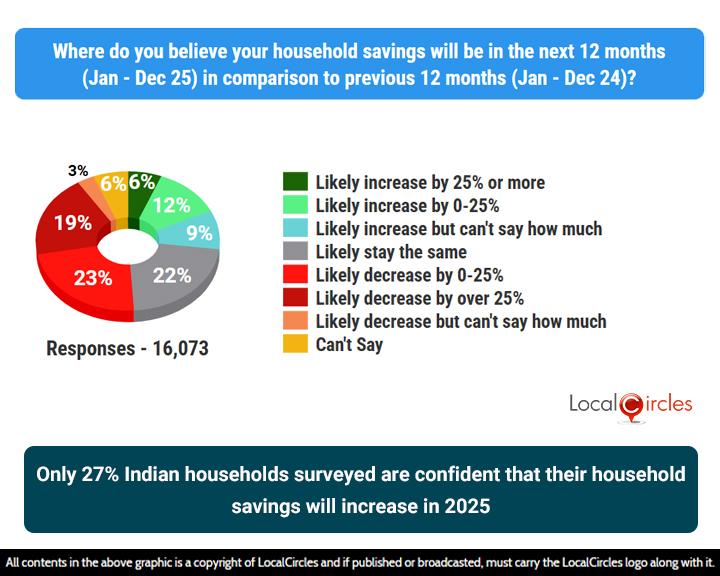

Only 27% Indian households surveyed are confident that their household savings will increase in 2025

With incomes of most families not keeping pace with rising costs and expenditure, not just on food and groceries but service expenditures like rent, school fee, transportation costs and mobile phone bills, households have been dipping into their savings. The survey next asked household consumers, “Where do you believe your household savings will be in the next 12 months (Jan- Dec 25) in comparison to previous 12 months (Jan- Dec 24)?” Out of 16, 073 who responded to the question 6% stated “likely increase by 25% or more”; 12% of respondents stated “likely increase by 0-25%”; 9% of respondents stated “likely increase but can’t say how much”; 22% of respondents stated “likely stay the same”; 23% of respondents stated “likely decrease by 0-25%”; 19% of respondents stated “likely decrease by over 25%”; 3% of respondents stated “likely decrease but can’t say how much”; and 6% of respondents did not give a clear answer. To sum up, only 27% Indian households surveyed are confident that their household savings will increase in 2025; 45% of households surveyed expect up to 25% dip in savings this calendar year.

In summary, the outlook for household earnings and savings both indicate a massive squeeze as only 24% Indian households surveyed are confident that their annual income will increase in 2025. With majority of the households seeing cost of living rise, majority are dipping into their savings to get by. Only 27% Indian households surveyed are confident that their household savings will increase in 2025. In fact, the survey data shows that 45% of households surveyed expect up to 25% dip in savings this calendar year. As households across the country grapple with this massive squeeze, Budget 2025 must consider some serious interventions that will assist them.

Survey Demographics

The survey received over 32,000 responses from household consumers located in 334 districts of India. 67% respondents were men while 33% respondents were women. 40% respondents were from tier 1, 27% from tier 2 and 33% respondents were from tier 3 and 4 districts. The survey was conducted via LocalCircles platform, and all participants were validated citizens who had to be registered with LocalCircles to participate in this survey.

About LocalCircles

LocalCircles, India’s leading Community Social Media platform enables citizens and small businesses to escalate issues for policy and enforcement interventions and enables Government to make policies that are citizen and small business centric. LocalCircles is also India’s # 1 pollster on issues of governance, public and consumer interest. More about LocalCircles can be found on https://www.localcircles.com

For more queries - media@localcircles.com, +91-8585909866

All content in this report is a copyright of LocalCircles. Any reproduction or redistribution of the graphics or the data therein requires the LocalCircles logo to be carried along with it. In case any violation is observed LocalCircles reserves the right to take legal action.