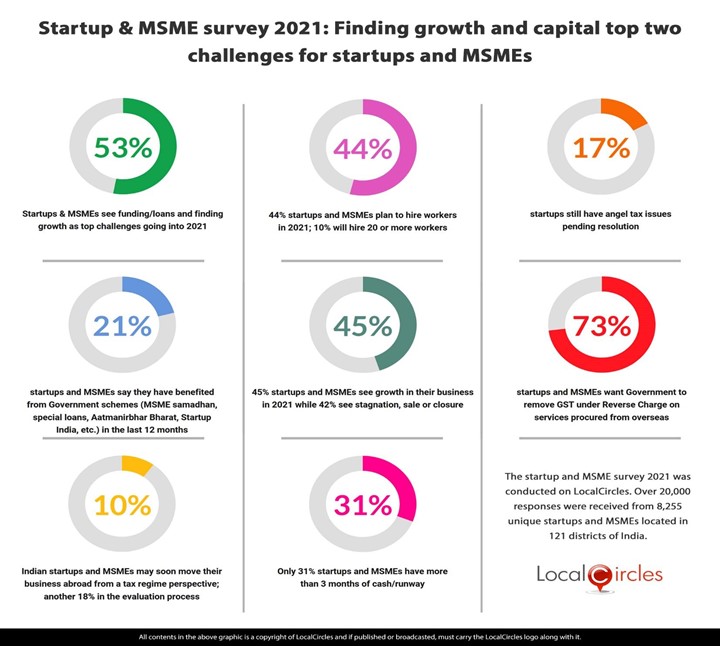

Annual Startup and MSME Survey 2021 - Finding growth and capital are top two challenges for startups and MSMEs this year

- ● Only 31% of Startups & MSMEs have cash reserves to sustain for more than 3 months

- ● 21% startups and MSMEs benefitted from Government Schemes in 2020

- ● 44% of Startups and MSMEs plan to hire work force in 2021

Startup & MSME survey 2021: Finding growth and capital are top two challenges for startups and MSMEs

January 15, 2021, New Delhi: The year 2020 has tested the pulse of Indian Startups and Micro Small & Medium Enterprises (MSMEs) because the COVID-19 crisis impacted their growth and challenged the survival of many to cessation. The pandemic and subsequent lockdowns since March-end caused a drastic fall in their revenue traction as all sectors that support the country’s economy came to a standstill as citizens observed social distancing amid the outbreak. 2020 was an unprecedented year that tested every organisation on their readiness to pivot and adapt to the new normal. Although the Cabinet approved INR 3 lakh crore emergency credit line to the MSME community, a large number of startups and MSMEs didn’t avail these benefits under the Atmanirbhar Bharat scheme as they didn’t’ have existing debt or loans on their books to qualify.

LocalCircles has been collecting inputs from Startups and MSMEs through 2020 to understand and escalate the challenges they faced during the pandemic. In late December, LocalCircles concluded its annual survey, “Pulse of the Startups & MSMEs - 2021 edition” with over 20,000 responses received from more than 8,000 Startups and MSMEs across India to ascertain their current state of affairs, challenges, hiring plan, cash flow and outlook amongst a host of issues. It also gathered their experience dealing with pending issues related to Angel Tax, whether or not they benefitted from any of the government schemes, expansion plans, along with their perception on removing GST under reverse charge on services procured from abroad. Their responses were also compared with previously conducted surveys on the subject to understand the change over time.

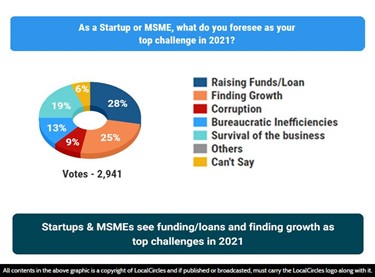

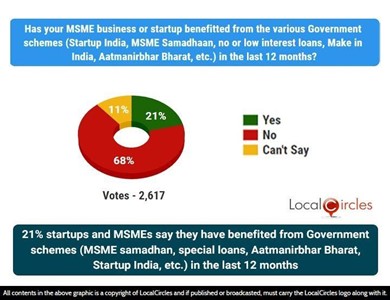

Top challenges for Startups & MSMEs in 2021

The first question to Startups and MSMEs asked, “What do you foresee as your top challenge in 2021?”. It was found out in the poll that they see funding or loans and finding growth as the top challenge going into 2021. Further 28% listed raising funds or loans as top challenges, while another 25% are worried about finding growth. There were also 19% who said they worry about the survival of their business, and 13% maintained bureaucratic inefficiencies as their top challenge in 2021. The question received 2,941 responses. In 2021, most Startups & MSMEs see funding or loans and finding growth as top challenges going forward. In the previous survey, Startups and SMEs had voted securing funding or loans as their top challenge in 2020. Certainly, the unprecedented spread of coronavirus induced pandemic and subsequent lockdowns across the country made investors sit back and carefully evaluate the prospects of returns on their investment on Startups and MSMEs. With economic recovery starting in September 2020, the uncertainty of new coronavirus strains, as startups and MSMEs adjust to the new normal, finding growth for their business and the necessary funds and capital are seen the top challenge.

Startups & MSMEs see funding/loans and finding growth as top challenges in 2021

Many more startups and MSMEs see Finding Growth as their challenge in the coming year in comparison to this year

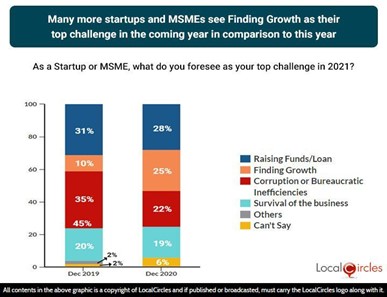

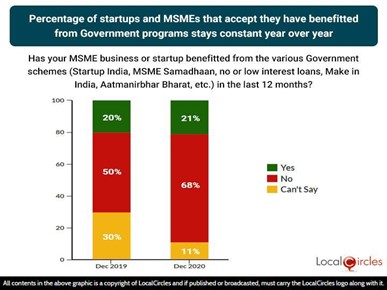

Govt schemes availed by Startups & MSMEs in 2020

The Government in 2020 introduced various schemes to address the financial crisis faced by Startups and MSMEs, by way of giving them access to credit amid a squeeze on liquidity. Atmanirbhar Bharat Abhiyan, for instance, provides registration for many MSMEs and startups, along with access to liquidity measures such as MSME incubators, etc. As for the benefits for MSMEs or Startups from the various Government schemes like Startup India, MSME Samadhan, no or low interest loans, Make in India, Aatmanirbhar Bharat etc., in the last 12 months, 21% said that they have benefitted from the Government schemes. On the other hand, 68% said no. This poll question received 2,617 votes. The percentage of Startups and MSMEs who have accepted to have benefitted from Government programs stays constant year-over-year. To the similar question, 18% in 2018, 20% in 2019 and 21% in 2020 said to have benefited from the various Government schemes.

21% startups and MSMEs say they have benefitted from Government schemes (MSME samadhan, special loans, Aatmanirbhar Bharat, Startup India etc) in the last 12 months

Percentage of startups and MSMEs that accept they have benefitted from Government programs stays constant year over year

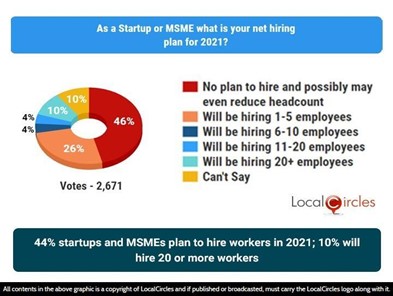

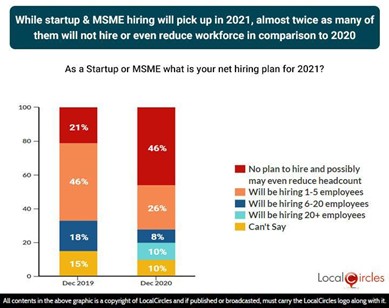

2021 hiring plan of Startups & MSMEs

Most Startups and MSMEs tread cautiously before adding any new changes in their business operation facing the impact of the COVID-19 pandemic and subsequent lockdowns. In reality, many were forced to initiate layoffs to sustain their operation. Per report by the International Labour Organization (ILO) and the Asian Development Bank (ADB), as many as 41 lakh youths in the country lost jobs due to the pandemic. As businesses across sectors now try to reset for growth, the survey tried to understand their hiring plans come 2021. When asked, “What is your net hiring plan for 2021?”, the survey found out that 44% startups and MSMEs plan to hire workers in 2021. Among the 2,671 responses the question received, 46% voted for the option “no plan to hire and possibly may even reduce headcount.” There were 26% who maintained that they would be hiring 1-5 employees, while 10 % were of the opinion that they would hire 20 or more workers. Although Startups and MSMEs have maintained to speed up hiring in 2021, almost twice as many of them will not hire or even reduce workforce in comparison to 2020.

44% startups and MSMEs plan to hire workers in 2021; 10% will hire 20 or more workers

While startup & MSME hiring will pick up in 2021, almost twice as many of them will not hire or even reduce workforce in comparison to 2020

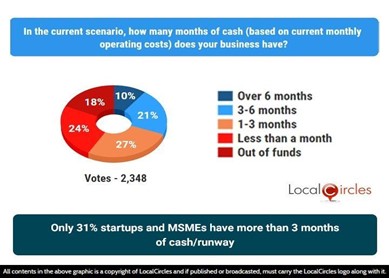

Cash flow situation at Startups & MSMEs

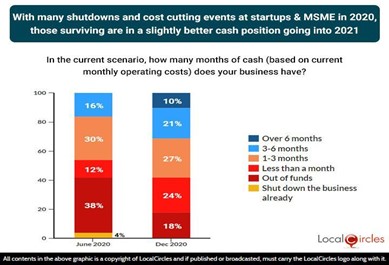

It’s difficult to predict how long the pandemic will last, so small businesses who don’t have reserves need strategies to cover their costs. The poll tried to find out from them the remaining months of cash (based on current monthly operating costs) does their business have in the current scenario. It was found out that only 31% of them have more than 3 months of cash or runway. The figures when further broken down, 27% said “1 to 3 months”, 24% said “less than a month”, while 21% said “3 to 6 months”, and there were about 10% who said “more than 6 months”, and 18% maintained they were out of funds. On June 15, 2020, LocalCircles survey indicated that only 16% of India’s Startups and SMEs had cash to survive for more than 3 months, while 42 were already out of funds or in shutdown stage. However, most Startups and MSMEs were able to pivot and overcome the challenges caused by Covid pandemic, as a result those surviving are in a slightly better cash position going into 2021.

Only 31% startups and MSMEs have more than 3 months of cash/runway

With many shutdowns and cost cutting events at startups & MSME in 2020, those surviving are in a slightly better cash position going into 2021

Startups & MSMEs 2021 outlook

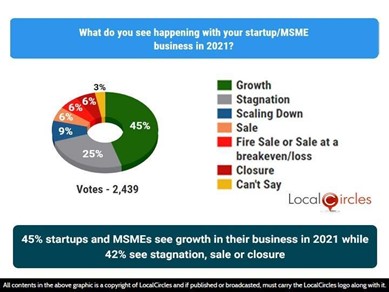

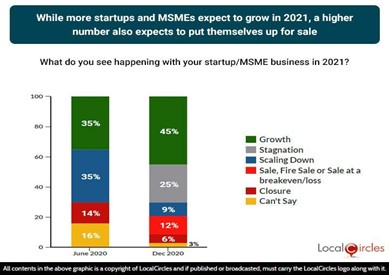

For Startups and MSMEs that survived, many found new revenue streams or started offering different services or products that work with the new normal. 45% startups now expect growth in their business come 2021. However, 42% see stagnation, sale or closure when it comes to seeing what happens to their business in 2021. Breaking it down further in the poll which had 2,439 votes being cast, 25% voted for stagnation. LocalCircles survey published in June indicated that 35% expected growth, 35% were scaling down, 14% were thinking to put themselves up for sale, and 14% were shutting down. The findings from the latest survey indicated that while most Startups and MSMEs expect growth in business in 2021, 12% of them expect to put themselves up for sale.

45% startups and MSMEs see growth in their business in 2021 while 42% see stagnation, sale or closure

While more startups and MSMEs expect to grow in 2021, a higher number also expects to put themselves up for sale

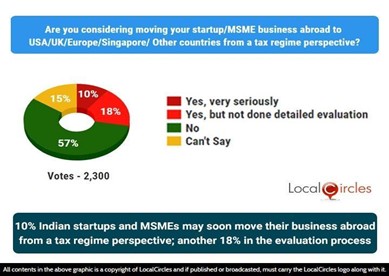

Are Startups & MSMEs moving abroad due to taxation issues?

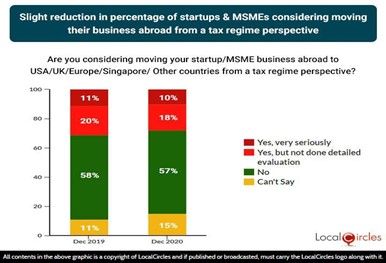

For many years now, Startups and MSMEs have been reeling under the complex burden of India’s difficult taxation policies and as a result often seek ground with taxation-friendly countries. Many a times this is a requirement from global venture capitalists. A complex, unfriendly tax system is a big reason why many unicorn startups have relocated their registered headquarters outside India. In 2020 survey, the result indicated that 11% of Startups and SMEs were very seriously considering moving their primary business location abroad. This year as well, the survey dwelt into the possibility of Startups and MSMEs moving abroad to the USA, UK, Europe, Singapore or other countries, from a tax perspective. 10% said that they are very seriously considering moving abroad, while another 18% are considering but haven’t done any evaluation. Further, the majority of 57% said “No” to the question, which received 2,300 responses.

10% Indian startups and MSMEs may soon move their business abroad from a tax regime perspective; another 18% in the evaluation process

Slight reduction in percentage of startups & MSMEs considering moving their business abroad from a tax regime perspective

Pending Angel Tax Section 56(2)(viib) issues

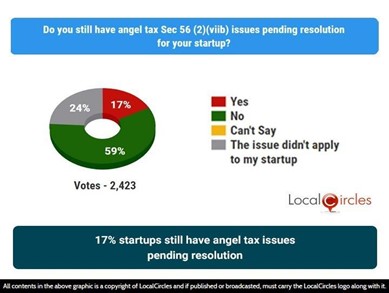

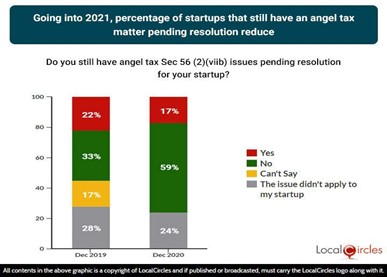

Finance Minister Late Pranab Mukherjee in 2012-13 introduced Angel Tax to put a check on cases of black money, which was finding its way into shell companies as equity capital. It soon became a burden for many startups and though the Government announced several exemptions, those with pending demand orders are still going through the process of hearing with CIT who if satisfied may accept their appeal based on the exemption and grant relief. LocalCircles survey in February 2019 was quick to highlight that 73% of Startups that had raised angel capital had gotten a scrutiny notice under Section 56 (2) (viib). The Ministry of Finance taking cognizance of the issue then brought out angel tax exemption based on self- certified investment declaration for DPIIT registered Startups. In 2020 survey, LocalCircles raised the question to Startups “Do you still have angel tax Section 56 (2)(viib) issues and pending resolution?”, 33% said “‘no”, while 22% said “yes”. To the similar question in this year’s survey, 17% maintained that they still have angel tax issues pending resolution. From the 2,423 respondents, 59% said “no”, while 24 % said the issue did not apply to their business. The latest survey findings indicate that although the percentage of Startups saying angel tax matter pending resolution have reduced, 17% startups still have an open issue.

17% startups still have angel tax issues pending resolution

Going into 2021, percentage of startups that still have an angel tax matter pending resolution reduce

Startups & MSMEs views on GST reverse charges

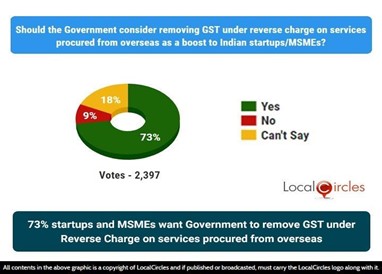

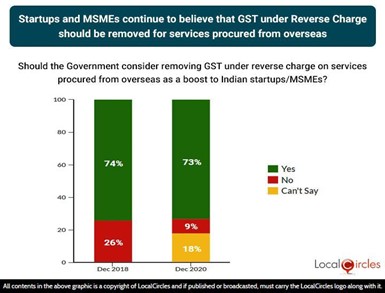

Startups and MSMEs continue to demand the removal of GST under reverse charge for services procured from overseas. LocalCircles had taken up the issue with the Finance Ministry multiple times in 2019. Many seed stage startups procure cloud, data and security services from abroad as most aren’t available in India. These startups do not have enough revenue and hence GST output to offset the GST paid by them under reverse charge leading to an increased cost of 18% for being located in India. In most other countries, startups do not incur this additional tax. When startups were asked “Should the Government consider removing GST under reverse charge or services procured from overseas as a boost to Indian Startups and MSMEs?” 73% agreed, while less than 9% did not agree. There were 2,397 responses to this question. The findings of the latest survey with comparison to last year’s survey indicated that Startups and MSMEs continue to believe that GST under Reverse Charge should be removed for services procured from overseas. Even experts on the matter have highlighted that the Government should bring clarity to the law related to GST under reverse charge.

73% startups and MSMEs want Government to remove GST under reverse Charge on services procured from overseas

Startups and MSMEs continue to believe that GST under Reverse Charge should be removed for services procured from overseas

In addition, the startup community has demanded that the Government must act to ensure that the long pending ESOP demand of startups is addressed. Startups are willing to provide a declaration that identifies them appropriately similar to the angel tax declaration such that ESOPs are taxed at sale and realisation point and not on exercise. This single issue will ensure that seed stage startups are able to attract better as well as experienced talent.

Similarly, the Government must consider permitting deployment of CSR funding into social impact startups. These startups are the ones who can help solve real challenges of India ranging from environment, health, water, women and child safety to community awareness and engagement in democracy.

As Government of India marks the 5th anniversary of Startup India launch this month and as COVID-19 cases subside in India from 80,000 a day to 15,000 a day, the Government must address some of the issues listed above to make the operating environment more conducive for startups and MSMEs. While the risk of new B.1.1.7, E484K and other strains of coronavirus coming to India is very real, the vaccine now being available is a huge positive. One thing that is certain though is that uncertainty can arrive any time in 2021 but with the learnings of 2020 Covid-19 pandemic and small business friendly governance, Indian startups and MSMEs can do much better.

Survey Demographics

Over 20,000 responses were received from 8,255 unique startups, SMEs and entrepreneurs located across 121 districts of India. 42% of the businesses were from Tier 1 cities, 38% form Tier 2 Cities and 20% from Tier 3 and rural locations.

About LocalCircles

LocalCircles, India’s leading Community Social Media platform enables citizens and small businesses to escalate issues for policy and enforcement interventions and enables Government to make policies that are citizen and small business centric. LocalCircles is also India’s # 1 pollster on issues of governance, public and consumer interest. More about LocalCircles can be found on https://www.localcircles.com

For more queries - media@localcircles.com, +91-8585909866

All content in this report is a copyright of LocalCircles. Any reproduction or redistribution of the graphics or the data therein requires the LocalCircles logo to be carried along with it. In case any violation is observed LocalCircles reserves the right to take legal action.